Claim for division of debts. Division of debts in case of divorce of spouses - a sample application. When a counterclaim is filed

Credit obligations belong to the category of jointly acquired property and, in the event of a divorce, are subject to division between spouses in accordance with the norms of marriage and family legislation. This procedure carried out in judicial order. The basis for its implementation is a statement of claim on the division of credit obligations between former spouses compiled according to the sample.

In what cases is it possible to divide debts on a loan between spouses?

The Family Code determines that all property, finances, loan obligations and other debts that were acquired in the course of family life, but not after a divorce, are common property. But there are some nuances here.

Yes, debt credit card of one of the spouses, if it is not proved that the funds withdrawn from her were spent on the needs of the family, it is his personal debt and is not subject to division after a divorce. If the owner of the card can provide the court with documentary evidence that through its use the equipment or other goods that were purchased for the home were paid for, the debt will be divided in accordance with the Family Code.

Credit obligations to financial institutions cannot be considered general if the funds were used for the personal needs of the husband or wife, for gambling, for the maintenance of a mistress and so on. All this must be indicated in the claim when it is filed with the court.

As for mortgages, as well as large loans taken to purchase other expensive property, it is much easier to figure it out. This is due to the fact that when issuing such loans, banking organizations are reinsured and require the conclusion of a marriage contract, which clearly spells out the obligations of each of the spouses, which are also fulfilled after a divorce.

Also, there are no special problems with the division of loans if the second spouse acted as a guarantor during their registration.

Claim Form

There are two main options for dividing loan debts between spouses: through the conclusion of a settlement agreement (marriage contract) or through the courts. If in the first case the procedure is carried out quickly and painlessly for each of the parties, then in the second case it is necessary to expend both effort and time.

The family legislation of the Russian Federation allows for the possibility of presenting claims for the division of debts both as a separate item in the statement of claim for the division of property, and through registration in the form of a separate statement of claim after the divorce. The legislation does not provide for a strict sample of filling it out, but certain requirements are nevertheless put forward.

- details of the judicial authority;

- passport information of the parties to the process (plaintiff and defendant);

- details of the banking, credit or other type of organization in which the loan is issued;

- the cost of the claim is the amount of credit obligations that are subject to division between the spouses;

- title of the claim;

- information about the loan: the date of registration, the circumstances under which it was taken, its total amount, the balance of the debt after the divorce or at the time of the filing of the claim, if the division of property occurs simultaneously with the dissolution of the marriage;

- reference to the normative act;

- request to carry out the section of debt obligations;

- list of attached documents;

- number and signature of the originator of the claim.

A sample of filling out a claim can be requested from the judicial authority to which it will be filed. If you cannot cope with this on your own, you can turn to lawyers or lawyers working in this direction who will help you fill out a statement of claim in accordance with the sample.

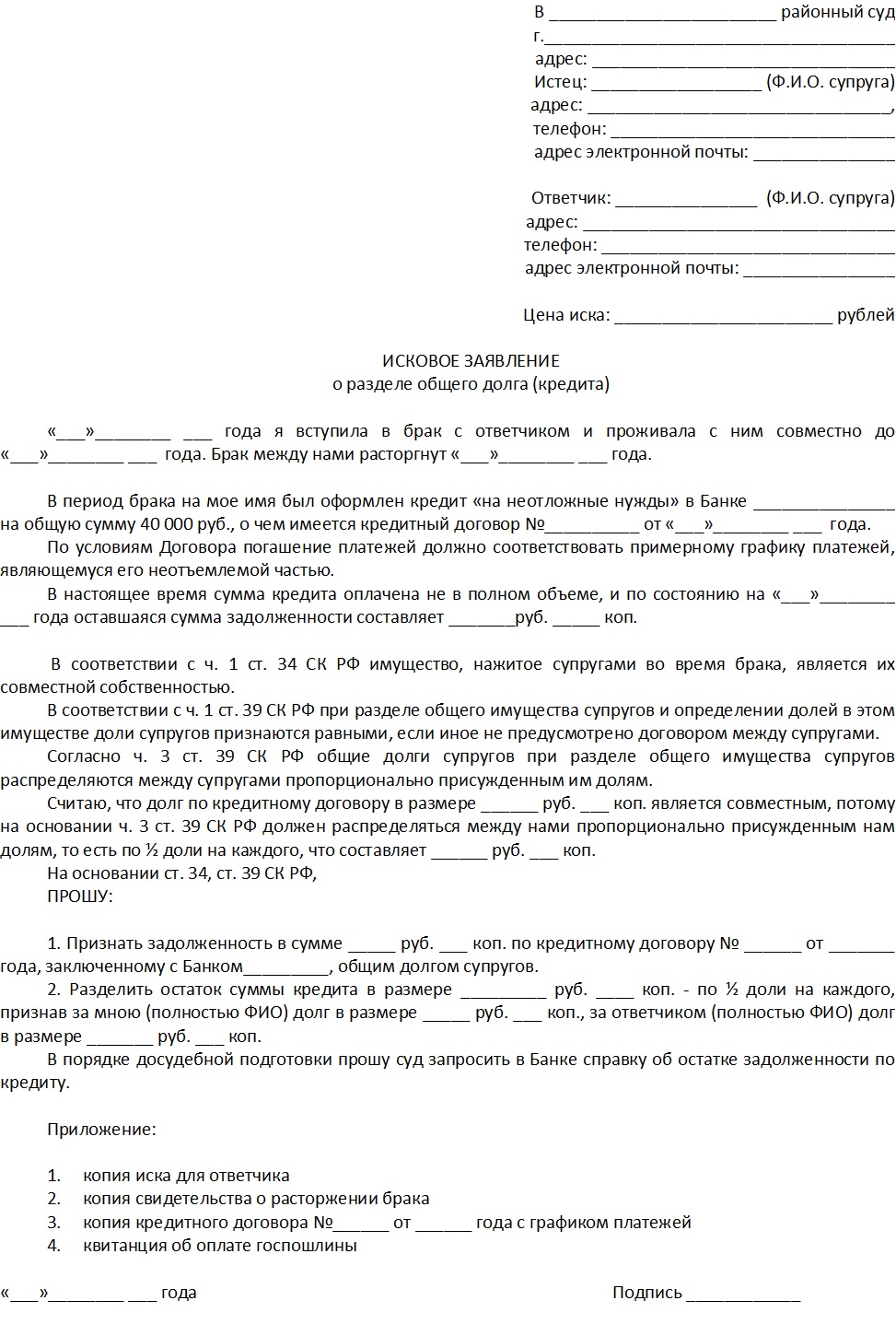

You can also download the application form:

Procedure for filing a claim

A claim of the established form must be submitted accompanied by a package of documents that can confirm the legitimacy of the claims. The list may vary depending on whether the claim is filed along with the application for divorce, or after a divorce.

Documents required to be submitted along with the claim:

- photocopies of passports of each of the spouses between whom the division of debts is carried out;

- certificates fixing the fact of marriage and its dissolution;

- a loan agreement, as well as a guarantee agreement, if any;

- a certificate from a banking organization, which indicates the terms of payments and the amount of their repayment;

- documents confirming the acquisition of property and other objects for credit funds (contracts, receipts, etc.);

- receipt of payment of state duty.

The court in which a claim is filed for the division of obligations on a loan directly depends on its value. If it is less than 50 thousand rubles, then you should apply to the world court at the place of residence of the defendant, if more, then to the district court.

The limitation period for the procedure for the division of credit obligations between spouses is 3 calendar years. In this case, the countdown is carried out not after the dissolution of the marriage, but from the moment when the injured party became aware of the violation of her rights.

When filing a claim, it is also necessary to notify the bank in which the loan was issued. This is necessary to comply with the interests of each of the parties, which include directly the banking organization. If this is not done, bank representatives may decision appeal and the process will be delayed for an indefinite time until all the circumstances are clarified.

By general rules, regulated by the Russian legislator, the debt obligations of the spouses to credit institutions are regarded as jointly acquired and require the same division procedure as movable and immovable property. Usually, such an event is carried out judicial order general procedural guidelines. It can be initiated by any of the failed spouses, between whom the marriage relationship is terminated, for which an appropriate petition must be drawn up.

Dear visitors!

Our articles are informational in nature on the solution of certain legal issues. However, each situation is individual.

To solve a specific problem, fill out the form below, or ask an online consultant a question in the pop-up window below, or call the numbers listed on the site.

Claim for division of a joint loan after a divorce

requires knowledge of certain rules for compiling petitions of this kind, and therefore for writing it it would be most reasonable to contact a qualified specialist or see an example of such a document by clicking on the links indicated.

General rules

Standard banking products are usually issued to spouses according to two formulas that have already become traditional:

- the loan is issued to one of the spouses, while the second is the guarantor;

- the loan is issued to both, while in relation to each other they act in the status of co-borrowers.

This approach is explained by the need of a credit institution to obtain guarantees that the obligations of the parties will be properly performed (even if their marriage is dissolved), since, in fact, the responsibility lies with both of them.

Most often, disputes between failed spouses (and, as a result, applications to the court) arise in cases where an agreement with a bank was concluded by one of them (usually loans for relatively small amounts are provided on such conditions), and the person which is not formally involved in obtaining a loan, does not want to recognize the obligation to return the issued funds. Until relatively recently, such behavior was rarely supported by the court, and a loan granted to one of the spouses was considered a priori spent on meeting the needs of the entire family. Therefore, the obligations that arose before a credit institution were usually recognized as general. In the same cases when provided by the bank cash were spent on the personal needs of the debtor, this fact had to be proven by the second spouse, who was interested in ensuring that the debt obligations were assigned exclusively to the borrower.

From the beginning of 2017 to judicial practice there have been radical changes in cases like this. According to a published review by the Supreme Court, controversy on the division of property between persons terminating the marriage, the burden of proving that family needs have caused the debt to arise rests with the spouse on whose behalf the claim is written and the requirement to divide the debt into parts is made.

Documentary preparation for the division of financial liabilities

Didn't find an answer? Free legal advice!

A statement of claim with a request to divide obligations to a credit institution between spouses is drawn up according to the rules regulated by the legislator in the Code of Civil Procedure of the Russian Federation (see sample claim). Among other things, the document in question must contain the following information:

- full details of the judicial authority to which the petition is addressed;

- information contained in the identity cards of the plaintiff and the defendant, as well as their contact details;

- comprehensive data of the credit institution that provided the loan;

- the cost of the service provided by the bank, as well as the total amount payable;

- a specific request, stated concisely and unambiguously;

- list of documents, checks, receipts and extracts attached to the claim.

Also, when drawing up a claim for division, it is advisable to describe in detail the circumstances under which the loan was issued, indicate the date the agreement was signed, and in addition, the purposes for which the spouses requested a loan from the bank and the balance of the debt.

Together with the application, three copies of it are submitted to the court, which are intended for the defendant, the representative of the credit institution, as well as for the plaintiff himself.

In addition, the application must be accompanied by:

- a check confirming the payment of the state duty;

- documents certifying the conclusion and termination of the marriage union;

- an agreement entered into with a creditor;

- guarantee agreement.

In addition to all of the above, together with the claim document, all the documentation available to the former spouses is provided, which makes it possible to judge on what needs the amount provided by the bank was spent.

The procedure for dividing liabilities to the bank

In the process of deciding on a claim for the division of financial responsibility between former spouses, the court must answer several fundamental questions. In particular, as follows from the above, it is necessary to establish the purpose for which the loan was received and to qualify the debt as personal or compatible.

According to the general procedural formula, loan obligations are distributed among the participants in legal relations in accordance with the shares in the property, the right to which they acquire as a result of the dissolution of the marriage union. So, acquiring two parts out of three of the entire cost of the dwelling, a person will be obliged to pay the same part of the amount of the debt.

When considering claims that contain requirements for the division of a loan during a divorce, representatives of credit institutions are necessarily involved in the process. The court takes into account their opinion regarding the distribution of responsibility between the former spouses, and also, if necessary, involves them as experts on issues related to their field of activity.

Often in cases where a representative of a credit institution was absent at the trial, and the decision made by the court obviously contradicts the fundamental provisions prescribed in the contract and infringes on the rights of the creditor, then the act can be appealed. If the bank expresses its consent with the decision of the court, then appropriate changes are made to the agreement with the bank. IN new edition a new person is also registered as a payer, and information appears in the text about the transfer of the entire amount (or part) of the debt to him. The terms of the new agreement may contain a condition under which the section of the loan will take place in other shares. In addition, in practice, the court quite often resorts to such a measure as the conclusion of new agreements in which each of the former spouses is responsible for financial obligations.

Joint property is not only acquired capital, but also common debt obligations. Mortgages, loans - part modern life. And when a marriage is dissolved, a natural question arises: who and how will be responsible for the bills? This article will explain in detail how to properly draw up an agreement between spouses.

How are the common debts of the spouses distributed in the division of property?

How the loan debt will be divided between the spouses depends on who it was issued to.

There are three ways to get a loan in marriage:

- For one of the spouses;

- One of the spouses acts as a guarantor;

- Co-borrowers - general loan.

When a loan is issued to one person, it is necessary to prove that it was taken for the needs of the family in order to divide it equally. In a divorce, who used this property and to whom it will remain will be taken into account.

If one person in the union acts as a guarantor for a loan, this means that if the lender, to whom everything is issued, stops paying it, the loan burden will fall on the guarantor both after the divorce and during cohabitation. In any case, the guarantor will pay the bills.

Personal loans, for example: buying a car that was used by only one family member, money for education, separate vacations, etc., are not divided equally upon dissolution of a marriage.

It is worth considering that there is a practice of fictitious debts - when one of the spouses signs false IOUs in order to reduce part of the property of the second partner when the union is dissolved. Such situations are resolved through the courts and with the help of qualified lawyers.

Application for the division of debts in a divorce - a list of documents

The main points that are indicated in the application are:

- Full name, passport details of the plaintiffs;

- Period with dates from and to being married;

- Subject of the claim: what and by how much should be divided;

- How much should the property be divided?

- Articles of the legislation of the Russian Federation are indicated on the basis of which the division should occur;

- Date and signature.

The following documents are attached to the application:

- Confirmation of marriage and divorce;

- Papers that confirm payment for things, their possession;

- Copy of the application.

How to file a claim for the division of debts in a divorce?

The statute of limitations for the division of debts after a divorce is 3 years. It starts with two things:

- Dissolution of the marriage union;

- When one of the parties found out about the debt. This may be after the divorce.

Depending on the amount of debt, you must contact:

- To the court at the place of residence, if the amount is less than 50 thousand rubles;

- District or city, if more than 50 thousand rubles.

Partition of debts in case of divorce of spouses - sample application

When filling out this section, you must be treated as accurately as possible. Basic requirements for its completion:

- A complete list of property for division;

- Describe items accurately: with brand, size, color, series, cost. Vague language is not accepted, such as TV. You need to specify: Sumsyng TV, series 2347653, year of manufacture 2002, dimensions 35 inches, cost 8000 rubles.

For real estate, indicate the number of storeys, total and residential footage, number of rooms, location.

It is necessary to prepare proof of the value of things, as the court may request them. If any documents are lost, you can contact an independent appraisal company for an examination. This is more true for expensive things, since you will have to pay extra for the company's services.

Personal items are not subject to division: clothes, shoes, with the exception of expensive and luxurious items.

State duty for filing an application for the division of debt between spouses

The state fee must be paid before filing a claim, proof of payment must be provided along with the application.

The amount of the state duty depends on the price of the claim, paid by the plaintiff. In a winning case, it is possible through the court to share the payment of state duty with the defendant.

The calculation of the state duty is prescribed at the legislative level:

- If the price of the claim is up to 20 thousand rubles - 4% of its value. The minimum fee is 400 rubles.

- If the price of the claim is from 20 to 100 thousand rubles, a minimum payment of 800 rubles and 3% of the value of the property is paid;

- With a total value of divisible things from 100 to 200 thousand rubles, the fee is calculated as follows: the minimum payment amount is 3200 rubles and 2% of the price of the property above 100 thousand rubles;

- In case of a claim for an amount from 200 thousand to 1 million rubles, it is necessary to pay 5200 rubles and 1% of the cost over 1 million;

- With the value of divisible property in the amount of 1 million rubles, you need to pay minimum size a fee of 13,200 rubles and 0.5% of the amount over 1 million rubles. At the same time, the maximum amount of state duty is fixed by law - 60 thousand rubles.

Judicial practice on the division of common debts in a divorce

In the case when the spouses are not able to share financial obligations on their own, this can be done in court. Debts are shared only acquired jointly. If they were formed before marriage and the partner was not notified about this, they are not subject to division, as well as loans for personal needs.

The decision of the court on the division of credit debts

The decision of the court may be as follows:

- Divide equally;

- Partial split: someone pays a large amount. taken into account financial situation and family. For example, if, after a divorce, the children remain with the wife, then it is possible that most of debt on the loan will remain on her husband.

Sample statement of claim for the division of property of spouses.

(This statement was made by us on specific situation for our client. It is counter, since it was stated in response to the defendant's initial statement also about the division of property of the spouses. Application approved in full.)

To the Oktyabrsky District Court

Novosibirsk

Novosibirsk, st. Turgenev, 221

Claimant: (full name, address, last name)

Respondent: (full name, address, last name)

Third parties: 1. JSC "Transcreditbank"

(represented by the Novosibirsk branch)

630004, Novosibirsk, st. Lenina, 86,

tel. 229 - 51 - 00

2. Home Credit and Finance Bank LLC

125040, Moscow, st. Pravdy, 8, bldg. 1

Tel. 8(495) 785 - 82 - 22

STATEMENT OF CLAIM

on the division of jointly acquired property

From March 11, 2000 to July 27, 2012, I was in a registered marriage with the defendant (full name).

During the period of marriage, for the needs of the family (namely, for the purchase of a Toyota Gaja car), we took consumer loans:

1. in the Novosibirsk branch of JSC "Transcreditbank" under contract No. ___________ dated __________ 2011. At the time of the decision to dissolve the marriage (June 27, 2012), the debt on this loan amounted to 184,853 rubles 47 kopecks (one hundred eighty-four thousand eight hundred fifty-three rubles 47 kopecks). The loan was issued in the name of the plaintiff (full name).

2. in the Novosibirsk branch of JSC "Transcreditbank" under contract No. _________ dated ____________ 2011. At the time of the decision to dissolve the marriage (June 27, 2012), the debt on this loan amounted to 38,298 rubles 13 kopecks (thirty-eight thousand two hundred ninety-eight rubles 13 kopecks). The loan was issued in the name of the plaintiff (full name).

3. in Home Credit and Finance Bank LLC under agreement No. __________ dated _______ 2011. As of September 22, 2012, the debt under this loan amounted to 126,178 rubles 88 kopecks (one hundred twenty-six thousand one hundred seventy-eight rubles 88 kopecks). The loan was issued in the name of the plaintiff (full name).

In accordance with Part 3 of Art. 39 family code RF, the total debts of the spouses in the division of the common property of the spouses are distributed among the spouses in proportion to the shares awarded to them.

According to par. 3 points 15 of the Resolution of the Plenum Supreme Court Russian Federation dated 05.11.1998 N 15 "On the application of legislation by the courts when considering cases of divorce" the composition of property subject to division includes common property spouses, available to them at the time of the consideration of the case or located by third parties. When dividing property, the total debts of the spouses are also taken into account (clause 3, article 39 of the RF IC) and the right to claim for obligations arising in the interests of the family. The general obligations (debts) of the spouses, as follows from the content of paragraph 2 of Article 45 of the RF IC, are those obligations that arose on the initiative of the spouses in the interests of the whole family, or the obligations of one of the spouses, according to which everything received by him was used for the needs of the family.

On the basis of the above,

ASK:

1. Make a division of property jointly acquired by (full name) and (full name) during the period of their marriage as follows:

Determine the share (full name) in the jointly acquired property as 1/2.

Recognize the debt to Transcreditbank OJSC under agreement No. _________ dated _______ 2011 in the amount of 184,853 rubles 47 kopecks (one hundred and eighty-four thousand eight hundred and fifty-three rubles 47 kopecks) as the total debt of the spouses, formed during the marriage (full name) and (full name). Distribute this debt between (full name) and (full name) in equal shares(1/2 share for each of them).

Recognize the debt to Transcreditbank OJSC under Agreement No. _________ dated _______ 2011 in the amount of 38,298 rubles 13 kopecks (thirty-eight thousand two hundred ninety-eight rubles 13 kopecks) as the total debt of the spouses formed during the marriage (full name) and (full name). Distribute this debt between (full name) and (full name) in equal shares (1/2 share for each of them).

To recognize the debt to Home Credit and Finance Bank LLC under agreement No. _________ dated _______ 2011 in the amount of 126,178 rubles 88 kopecks (one hundred twenty-six thousand one hundred and seventy-eight rubles 88 kopecks) as the total debt of the spouses formed during the marriage (full name) and (FULL NAME). Distribute this debt between (full name) and (full name) in equal shares (1/2 share for each of them).

2. Request a copy of Agreement No. _______ dated _______ 2011 and a copy of Agreement No. _______ dated _______ 2011 to Transcreditbank OJSC

3. Request a copy of agreement No. _______ dated _______ 2011 from Home Credit and Finance Bank LLC

APPLICATION:

1. certificate of JSC "Transcreditbank" under the agreement No. _______ dated _______ 2011

2. Certificate from OJSC "Transcreditbank" under contract No. _______ of _______ 2011

3. certificate of Home Credit and Finance Bank LLC under agreement No. _______ dated _______ 2011

Hello! My husband and I have been living separately since 2012, but we continue to be married. During the period of our separation, my husband took 2 loans in succession, then he could not pay them back. I think the bank has already sued him. I learned about these loans recently. And during our separation, I bought a car and country cottage area.

Now I am going to file a lawsuit in court for the division of property in agreement with my spouse, so as not to be responsible for his loans and so that my purchases remain only mine. How do I assess the value of property in a claim?

If the court orders my husband to pay the debt on loans, and the bailiffs start collecting debts, will they not have the right to seize my property after the division of property?

Sincerely, Svetlana.

According to the law, in a divorce, not only jointly acquired property is divided, but also jointly acquired debts, in particular, loans.

More information about the conditions under which loans are subject to division between spouses, what is the procedure for dividing loans, can be found in the article "". In this article, we will look at the rules for filing a claim for a section of a loan (as well as a counterclaim) for filing in court. You can download sample claims below.

How to file a claim for a loan section?

The claim must be drawn up in accordance with the requirements of Articles 131-132 of the Code of Civil Procedure of the Russian Federation.

The claim must contain the following provisions:

- the name and address of the court where the claim is filed;

- FULL NAME. claimant, date of birth, address of residence and registration, telephone;

- FULL NAME. defendant, date of birth, address of residence and registration, telephone;

- name, legal, actual address, telephone number of the third party - the bank where the loan was taken;

- claim price – the amount required to repay the loan and subject to division, the amount of the state fee.

- the name of the document - "Claim for the division of the loan";

- the circumstances in which the loan was taken: the date of marriage, the date and place of the loan, the purpose and purpose of the loan, the total amount of the loan, the amount paid and the balance of the debt on the loan, the date of dissolution of the marriage;

- reference to the norms of the law (Article 39 of the Family Code of the Russian Federation and Decree of the Plenum of the Supreme Court of the Russian Federation No. 15 of 1998);

- request to the court to divide the loan;

- application list;

- date and signature of the complainant.

The following documents must be attached to the claim:

- receipt of payment of the state duty for filing a claim;

- copies of the statement of claim and attachments according to the number of parties (for the court, for the plaintiff, defendant, third party);

- copies of passports;

- marriage and divorce certificate;

- loan agreement, surety agreement;

- a certificate from the bank on the amount of debt on the loan;

- bank statement with data on the terms and amounts of loan repayment;

- documents on the property acquired for credit funds - a contract of sale, a check, a receipt;

- other documents.

Sample claim for the division of credit obligations between spouses 2018

When and where to file a claim?

You can share loans simultaneously with the dissolution of the marriage. But in some cases, it will be easier and faster to first file a divorce (through the registry office or the world court, if there are no obstacles for this), and then apply for a loan division - to a district or city court (if the value of the claim is higher than 50 thousand rubles) or to world court (if the price of the claim is not higher than 50 thousand rubles). You can file a claim for a division of the loan at the same time as a claim for a divorce.

statute of limitations

The limitation period for filing a claim for division of credit is 3 years. But he begins his countdown not after a divorce, as many believe, but after the husband or wife became aware of the violation of their rights.

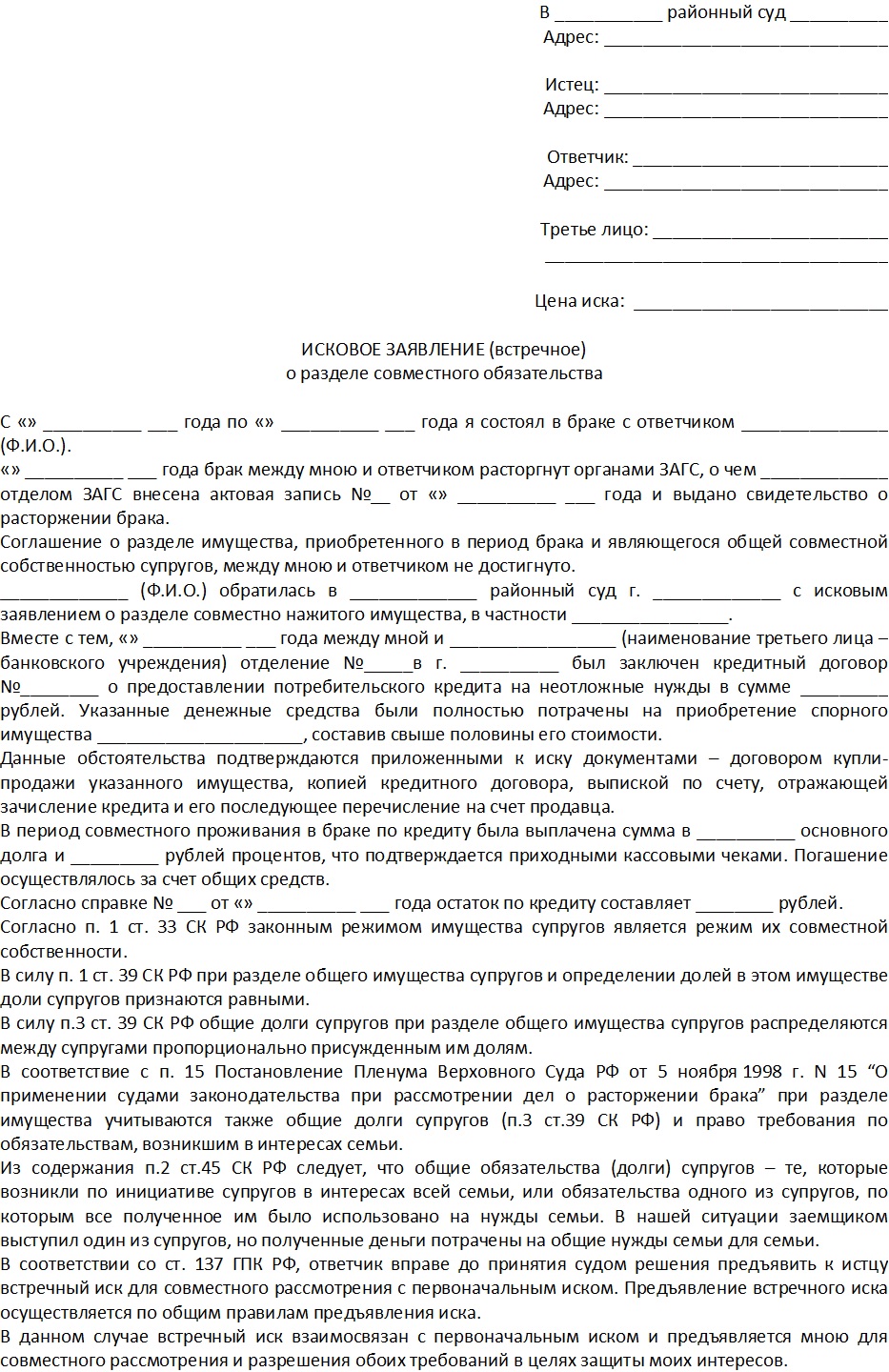

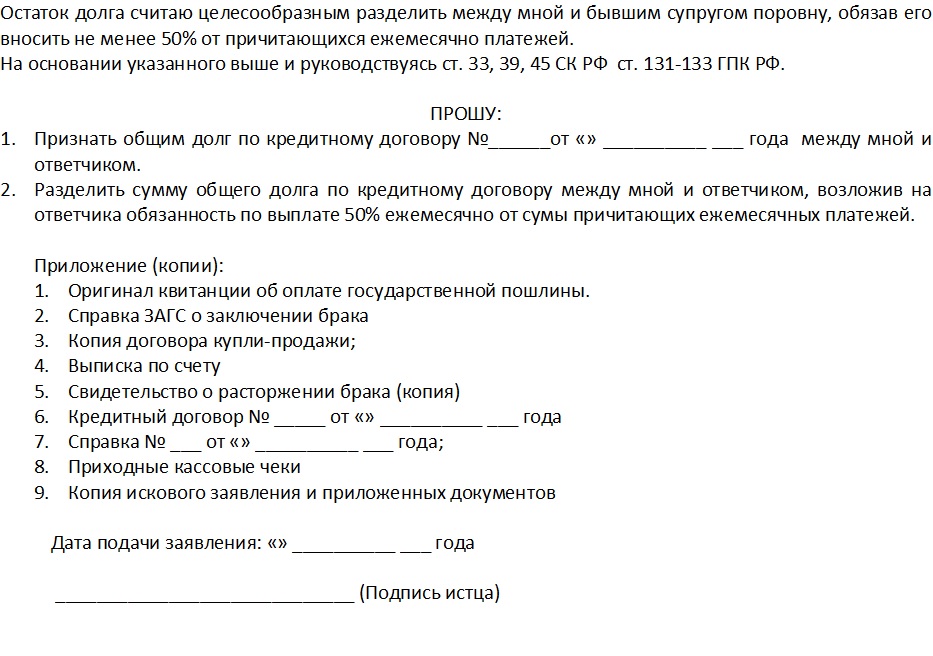

Counter claim for the division of debt obligations

The need to file a counterclaim most often arises when the loan was issued to one of the spouses, and the money was spent on joint family needs, or when there was a division of joint property, and joint debts remained undivided.

According to Article 138 of the Code of Civil Procedure of the Russian Federation, the court accepts a counterclaim for consideration as part of the main (initial) claim for the division of joint property and / or joint debts, if it meets all of the following conditions:

- The claim stated in the counterclaim may be set off within the framework of the claims specified in the main (original) claim;

- There is a connection between the main (initial) and counterclaims, and the consideration of two claims within the framework of one court case will contribute to a faster and more effective resolution of the marital dispute;

- Full or partial satisfaction of one or more claims of the main (original) claim will entail a refusal (full or partial) to satisfy the claims of the counterclaim. And vice versa;

When is a counterclaim filed?

According to Article 137 of the Code of Civil Procedure of the Russian Federation, filing a counterclaim in a case on the division of joint property and joint debts may be filed by the defendant at any stage litigation– both immediately after receiving a copy of the claim, and in the course of legal proceedings, but before the court decides final decision on business.

Lawyers advise filing a counterclaim during the first court session after the announcement of the claims. This will allow the court to consider the case simultaneously from two opposing positions. If the defendant needs to drag out the case, then it is better to do it in the middle of the trial, at the same time petitioning for the adjournment of court hearings in order to prepare a counterclaim - this will allow you to gain time to prepare for the proceedings.

Example

The plaintiff Stepan Trofimov filed a lawsuit to divide the jointly acquired Volvo car. At the hearing, the defendant Elena Trofimova filed a counterclaim for the division of the debt, stating that the Volvo car was purchased during the marriage on a loan issued in her name and paid by her alone after the divorce. The court divided the disputed car between the spouses, appointing Elena Trofimova to pay monetary compensation in favor of Stepan Trofimov equal to half the cost of the car, but in addition made a division of the debt, distributing it between the parties, taking into account the payments made earlier, so that financial compensation was partially set off against Peter Trofimov's debt on joint loan payments.

How to file a counterclaim

According to Article 137 of the Code of Civil Procedure of the Russian Federation, the same rules apply for filing a counterclaim as for filing a main (initial) claim. The requirements that apply to the initial statement of claim, established by the provisions of Articles 131-132 of the Code of Civil Procedure of the Russian Federation, also apply to counterclaims.

The counterclaim must contain the following information:

- Name of the judicial body, its address;

- FULL NAME. plaintiff (defendant in the main claim) and defendant, addresses and telephones;

- FULL NAME. third parties, if any, are involved in the case, addresses and telephone numbers;

- Title: "Counter Claim..."

- Information about the date of filing the main claim and the case number;

- Information on the subject of the dispute: statement by the plaintiff of the circumstances of the case (date of registration and divorce, list of disputed property and property obligations, the impossibility of division voluntarily, the existence of a dispute over ownership and / or fulfillment of debt obligations);

- Arguments about the need to file a counterclaim, about the relationship between the main (initial) and counterclaims, an indication that the joint consideration of claims will contribute to the speedy resolution of the dispute between the parties;

- Evidence that confirms all the circumstances listed in the claim (details of documents on the acquisition of property and / or the occurrence of debt);

- Links to legislation and judicial practice;

- Claimant's claims in a counterclaim;

- List of attachments to the claim;

- The date the claim was filed;

- Signature.

Sample counterclaim for debt division

You can use the template provided to create your own counterclaim.

![]()

However, keep in mind - the situation described in it is quite simple, in most cases a marital dispute involves much more complex circumstances - controversial legal status property and/or property liability (personal or joint), several large debts or material assets, participation of third parties (banks, credit institutions, individual creditors). From that. How well the counterclaim will be drawn up, how strong the evidence base will be, the result of resolving the dispute will depend. If you have any difficulties with the preparation of a counterclaim and supporting documentation, please contact the lawyers of our portal for a free consultation. Specialists in the field of family and civil law will help you competently prepare for the trial at any stage.

Features of filing a counterclaim

The procedure for filing a counterclaim is in many ways similar to the procedure for filing a main claim with the court, including, including ...

- The need to pay the state duty for filing a claim, which is calculated according to the general rules, in accordance with Article 333.19 of the Tax Code of the Russian Federation (for more information on the calculation of the state duty on claims for the division of debts, see our publication "");

- Strict observance of articles 131-132 of the Code of Civil Procedure of the Russian Federation, which relate to the form and content of the statement of claim. It is a mistake to believe that a claim that is filed as part of a civil case already under consideration will be studied by the court less carefully and exactingly - a counterclaim can be left without movement or returned to the plaintiff in exactly the same way as the main claim;

- Attachment to the counterclaim of copies of the statement of claim and documents - in such a number of copies as is required for distribution to all parties participating in the proceedings;

- Possibility of filing a counterclaim both in person and by mail or transfer through a trusted person;

- Possibility for the court to conduct preparatory measures before proceeding judicial trial. If the court considers that, in connection with the filing of a counterclaim, it is necessary to prepare, request additional information, it shall postpone the court session.

Timing

Filing a counterclaim in a case on the division of property and / or property obligations of the spouses always leads to an extension of the trial, since the course of the procedural terms is “zeroed out”, and statutory The 2-month period for the consideration of the civil case starts again from the moment the counterclaim is filed.

![]()

Whatever side of the legal battles you are on, it is advisable to enlist professional legal support. If a counterclaim is filed in response to your claim, if you intend to file a counterclaim on the division of debt, please contact our lawyers for a free consultation. Mistakes in the statement of claim, weak argumentation, insufficient evidence base - all this may well cause the court to refuse to accept a counterclaim, and the subsequent consideration of the case on the division of disputed rights or obligations without taking into account your claims. In this case, you will have to appeal the decision made by the court or go to court again with another statement of claim, and this is additional time, cash costs, mental strength.

Ask a question to an expert lawyer for FREE!